4 Point Inspection

Understanding the 4 Point Inspection

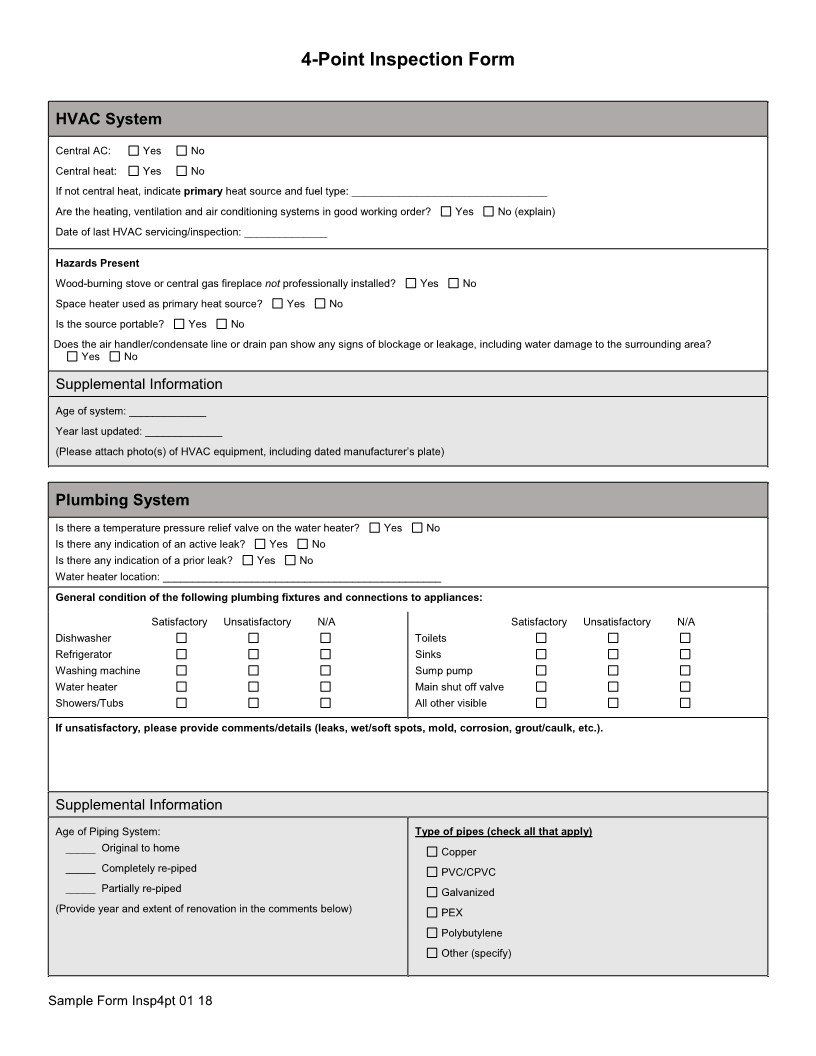

Homeowners who have older homes may need a four-point inspection before they can get home insurance. During a four-point inspection, an inspector evaluates how up-to-date four key systems are in your home, namely your:

- Electrical wiring and panels.

- Heating, ventilation, and air conditioning (HVAC).

- Plumbing.

- Roof.

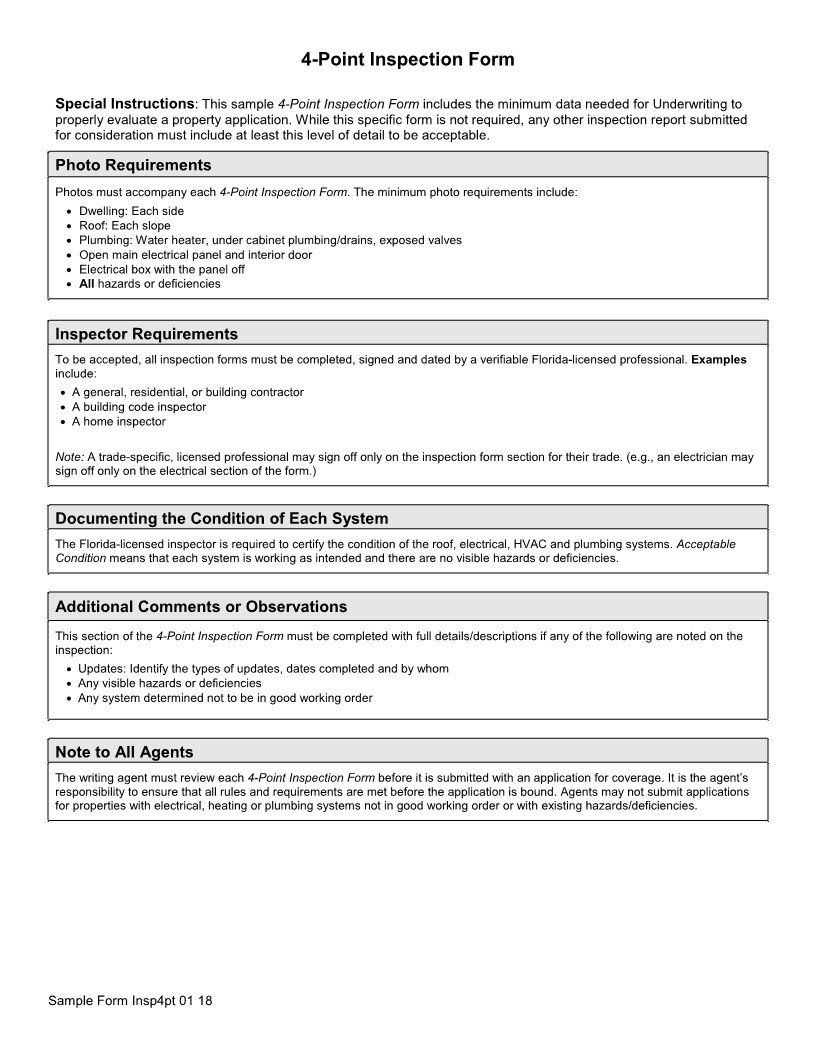

Four-point inspections identify key areas that most commonly result in insurance claims. If a home fails all or part of the inspection, the inspector will go over what needs to be fixed or replaced to alleviate deficiencies. The fixes may be necessary to obtain insurance.

You should note that a four-point inspection cannot replace a new home inspection. If your home insurance company says you have to have an inspection, be sure to ask specifically what type of inspection you need. As a homeowner, you sometimes must provide the right professional inspection report for your property to meet the requirements of getting your house insured.

Your 4-point home inspection checklist

Electrical wiring and panels:

Inquiring about the wiring setup in your residence? If your house utilizes copper, aluminum, or knob-and-tube wiring, it might face challenges in securing insurance coverage due to the inherent fire hazard. Inspectors will also verify if there's a presence of a recalled electrical panel.

Nearly 90 percent of residential fires stem from faulty wiring, a matter of grave concern for insurance providers. Should your home be deemed uninsurable due to wiring concerns, it's imperative to allocate funds for essential upgrades. Neglecting this could significantly heighten the risk of fire.

HVAC:

Is central heating and air conditioning installed in your dwelling? How's the condition of these systems? Any visible indications of damage like leaks? While each insurance firm sets its standards for insurability concerning older residences, a lack of central air and heat might lead to coverage denial.

Plumbing:

Inspectors scrutinize the piping material in your home to gauge the likelihood of pipe bursts. If polybutylene plumbing is detected, coverage denial is plausible as they are prone to bursting. Yet, certain insurers might extend coverage with water damage exclusions. In such instances, you bear full responsibility for any expenses incurred due to pipe bursts.

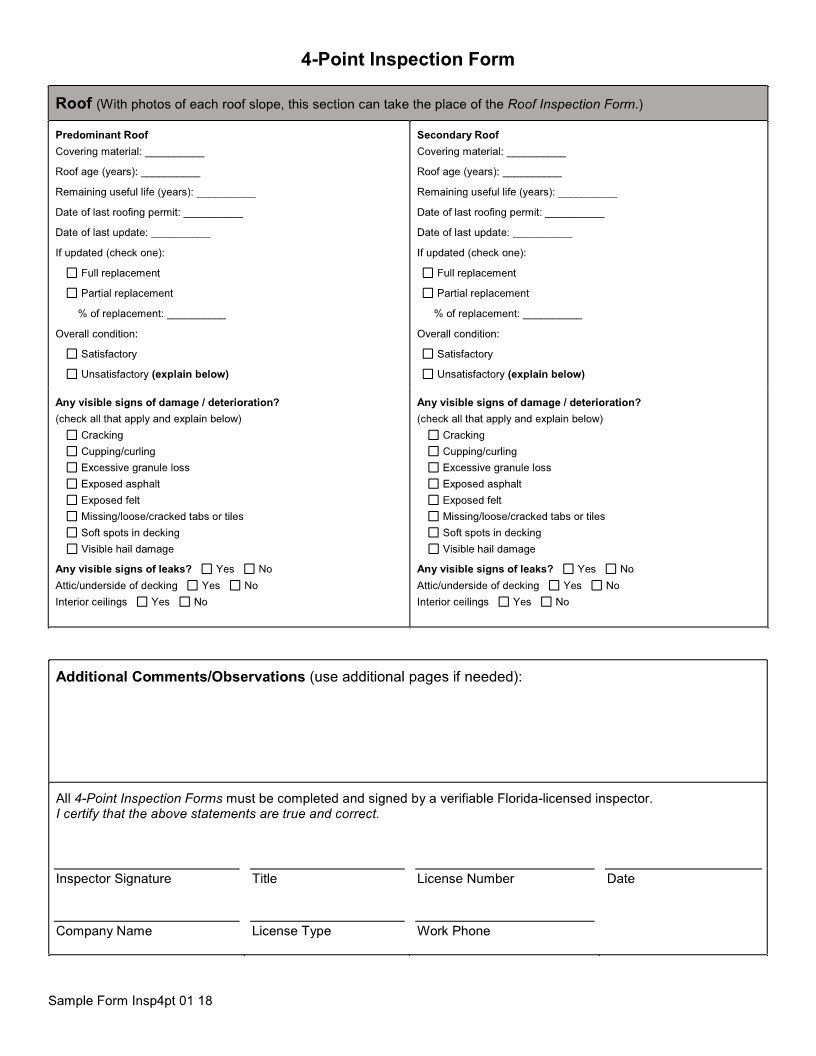

Roof:

What comprises a roof? Inspectors assess its age, material, and condition. Typically, insurance companies refrain from insuring shingle roofs over 20 years old, or tile and metal roofs over 40 years old. However, even a younger roof with apparent exterior damage or interior water leaks might warrant coverage denial.